Routine reentries mask the grind of orbital unit costs.

The return of ritonavir crystals from low Earth orbit marks a milestone for Varda Space Industries. Only the third private entity to recover payload from space, the company positions this as validation of commercial manufacturing above the atmosphere. Its chief executive, drawing from years at a launch provider, likens the trajectory to early reusable rocket skepticism now routine. Such parallels invite scrutiny of the structural parallels and divergences.

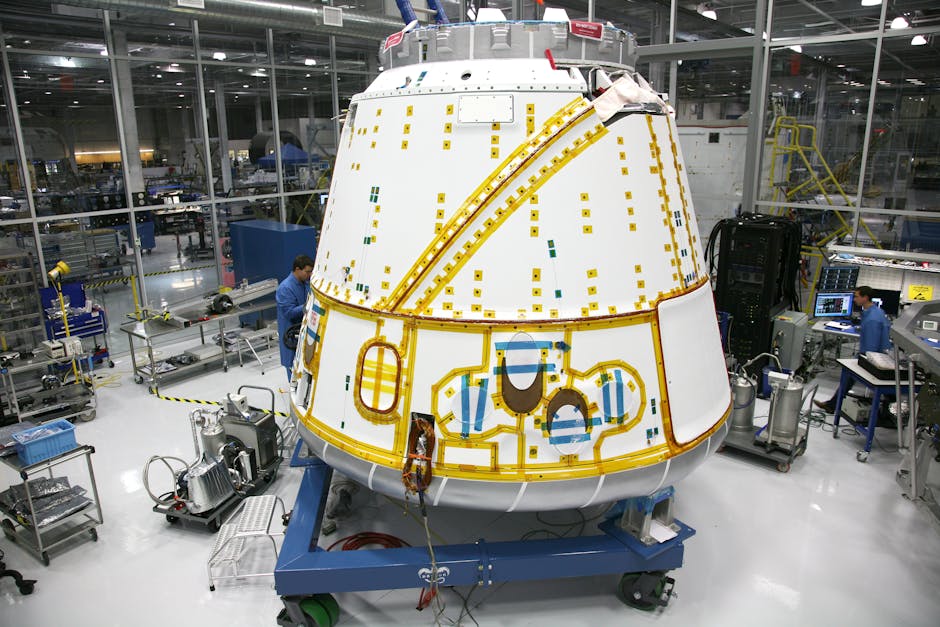

Regulatory clearance for reentry remains the gatekeeper few breach. Varda navigated months of federal oversight before its initial descent in early 2024. The Federal Aviation Administration oversees commercial spaceflight, including return vehicles under part 450 licensing. Precedents trace to SpaceX cargo missions and Boeing crew capsules, both backed by government contracts. Private ventures face stricter scrutiny on public safety risks. Capsule trajectories cross populated areas, demanding precise modeling of debris fields. Varda's conical return vehicle, modest in scale, still triggers the same probabilistic assessments as larger systems. Agency archives reveal repeated license modifications for orbital operators, often tied to anomaly reports. One prior suborbital firm lost a vehicle mid flight, prompting rule tightenings. Varda's approvals proceeded amid this caution, facilitated by rideshare manifests on established boosters.

The technical proposition rests on microgravity advantages. Absent sedimentation and buoyancy, crystal lattices form with tighter uniformity. Pharmaceutical firms long pursued this on the International Space Station, dispatching samples via government shuttles. Bristol Myers Squibb and Merck logged experiments yielding purer polymorphs, structures altering solubility and bioavailability. Station data informed patents, yet commercialization stalled on logistics. Varda inherits validated science, deploying automated ovens in capsules tethered to orbital buses. These platforms supply power and telemetry, detaching payloads for atmospheric plunge. Heat shields derived from space agency materials withstand hypersonic friction. Parachutes ensure recovery. The cycle spans weeks, contrasting terrestrial batch processes measured in days.

Business mechanics diverge from laboratory proofs. Varda forgoes novel molecules, refining approved compounds. Customers seek enhanced formulations immune to gravity distortions. Shelf life extensions or dosage efficiencies promise margins, but quantification eludes public disclosure. Unit costs embed launch fees, now commoditized via secondary payloads. A single booster carries multiple capsules, diluting per mission expense. Historical launch pricing plummeted from tens of millions per kilogram to thousands, mirroring electronics curves. Varda's fifth dispatch rode such a manifest, underscoring dependence on a single provider. Diversification lags, as alternative constellations prioritize constellations over capsules.

Venture capital patterns underpin the enterprise. Backers include funds favoring high risk orbits, injecting capital across rounds totaling over two hundred million dollars. Deployment aligns with a cohort of space alumni founding payload specialists. Similar outfits target remote sensing or satellite servicing, sharing regulatory moats. Burn rates consume payloads before revenue, with missions priced in the low millions each. Break even demands dozens of annual flights, scaling capsules to match station volumes. Pharma majors, conversant with orbital samples, hesitate on commitments. Intellectual property frameworks complicate transfers. Space Agency agreements govern station work, granting commercial rights post validation. Private orbits lack such templates, exposing litigants to jurisdiction gaps. A capsule failure mid descent invokes admiralty law tangles or product liability suits.

Institutional memory recalls analogous pivots. Early biotech platforms chased exotic production, from cell cultures to protein folding. Gravity independent claims echoed then, tempered by capital intensity. One firm scaled mammalian cell reactors terrestrially, bypassing orbital premiums. Varda counters with process exclusivity, polymorphs unachievable below the Karman line. Yet Earth bound centrifuges mimic microgravity for validation, blurring competitive edges. Regulatory bodies demand comparability studies for orbital variants. Food and Drug Administration pathways mirror biosimilar approvals, requiring equivalence proofs. Clinical trials absorb premiums only if efficacy lifts, a threshold unmet in public data.

Launch cadence accelerates the calculus. Provider manifests fill with constellations, squeezing rideshare slots. Varda's bus hosted capsules multiply output per ascent, amortizing fixed costs. Chief executive visions nightly reentries evoke air traffic models, but spectrum allocation and traffic management trail hardware. Federal Communications Commission dockets pile with orbital relay requests, presaging congestion. Collision avoidance protocols, codified in inter agency guidelines, extend to manufacturing swarms. Insurance markets adjust slowly, quoting premiums on failure probabilities refined by telemetry.

Pharma sector dynamics add layers. Blockbuster generics like ritonavir commoditize, eroding pricing power. Novel polymorphs invite extension patents, challenging originators. Litigation histories abound, courts dissecting crystal structures via x ray diffraction. Varda positions as neutral fabricator, licensing processes to incumbents. Absent marquee partnerships, revenue projections rest on bespoke runs. Industry analysts track station experiment yields, extrapolating to autonomous capsules. Economic models factor payload mass fractions, hovering below ten percent for current designs. Iterative capsules promise density gains, but engineering archives caution against optimism.

Supply chain interlocks reveal further tensions. Ablator materials trace to agency surplus, scalable only via qualified vendors. Parachute recoveries demand desert ranges or ocean barges, inflating logistics. Ground teams process under cleanroom protocols, mirroring aseptic fills. Scalability pivots on vertical integration, as bus providers eye end to end stacks. Varda's modular approach invites commoditization, capsules as interchangeable payloads.

Historical analogs surface in materials science. Orbital fiber drawing or alloy casting followed similar arcs, stalling on terrestrial substitutes. Venture portfolios diversify across vectors, mitigating single mission busts. Public markets shun pre revenue space plays, confining capital to private rounds. Exit paths converge on acquisition by defense contractors or pharma giants, precedents set by imaging firms.

Regulatory evolution lingers unresolved. Agency consultations on routine reentries propose streamlined licensing, contingent on flawless records. Varda contributes telemetry, bolstering case law. International norms, via United Nations committee, harmonize debris mitigation, binding domestic rules. Bilateral understandings with station partners facilitate data sharing, easing validation.

Workforce patterns mirror tech migrations. Engineers cycle from boosters to payloads, carrying cadence expectations. Talent pools concentrate in select corridors, bidding up salaries. Retention hinges on mission successes, as stock options vest on milestones.

Consumer implications embed in drug pricing. Marginal gains accrue to payers, if orbital premiums absorb via efficiencies. Generic tiers absorb innovations slowly, arbitraged globally. Payers scrutinize cost benefit dossiers, demanding head to head trials.

Orbital manufacturing threads through these interstices. Claims of proof confront entrenched scales. Reliance networks tighten around few nodes. Validation datasets accumulate, pressuring commitments. Tensions persist between demonstration and deployment.

By Tracey Wild

By Tracey Wild